Comprehending the Advantages and Difficulties of Developing an Offshore Trust for Property Security

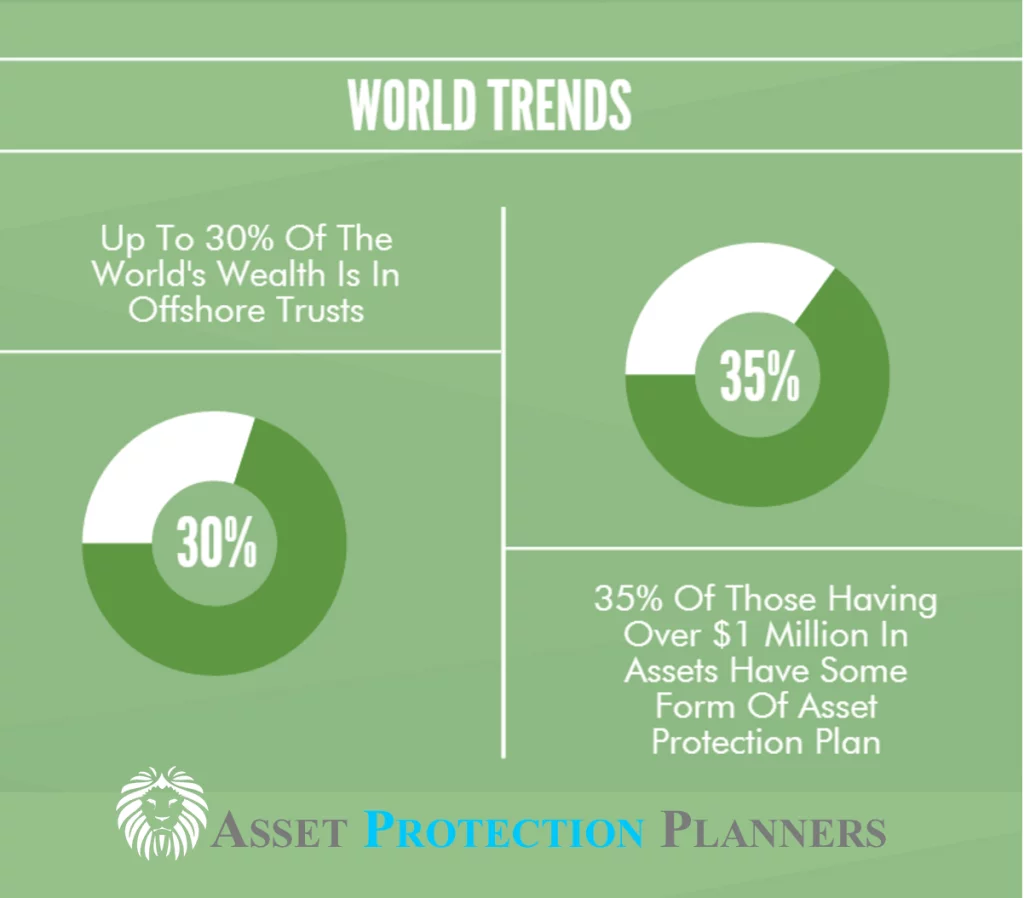

When taking into consideration possession defense, developing an offshore trust may seem appealing. It offers privacy, possible tax advantages, and a means to protect your properties from creditors. The complexities and costs entailed can be frightening. You'll require to navigate lawful considerations and conformity concerns that vary across jurisdictions. Are you prepared to evaluate these advantages versus the obstacles? The following actions might substantially affect your financial future.

What Is an Offshore Trust Fund?

An offshore depend on is a lawful setup where you transfer your assets to a trust that's developed outside your home nation. You can designate a trustee, who will oversee the trust according to your desires.

Secret Benefits of Offshore Depends On for Possession Security

When taking into consideration overseas trust funds for asset security, you'll find several essential benefits that can profoundly impact your financial safety. These counts on offer enhanced personal privacy, tax obligation benefits, and a legal guard from lenders. Comprehending these benefits can aid you make notified decisions concerning your possessions.

Enhanced Personal Privacy Security

Numerous people look for overseas counts on not simply for economic benefits, yet likewise for boosted personal privacy defense. By establishing an overseas depend on, you can separate your personal properties from your public identification, which can deter unwanted attention and prospective lawful cases. The majority of offshore territories supply strong privacy laws, making it tough for others to access your trust fund info.

Tax Benefits and Rewards

Beyond boosted privacy defense, offshore depends on also provide substantial tax obligation advantages and rewards that can in addition boost your financial technique. By developing an overseas trust, you may take pleasure in lowered tax liabilities depending on the jurisdiction you select. Several countries offer desirable tax obligation rates or exemptions for trust funds, allowing your assets to grow without the problem of too much taxation.

Legal Guard From Creditors

Establishing an overseas trust fund gives you a powerful legal shield against creditors, ensuring your assets remain safeguarded when faced with monetary difficulties. By putting your possessions in an offshore depend on, you produce a barrier that makes it hard for financial institutions to access them. This lawful framework can prevent possible claims and cases, as financial institutions might locate it testing to pass through the trust fund's defenses. In addition, overseas trust funds often operate under different legal jurisdictions, which can provide further benefits in property defense. You obtain assurance, recognizing your wide range is guarded from unpredicted economic difficulties. However, it is crucial to recognize the lawful needs and ramifications to completely benefit from this strategy, ensuring conformity and effectiveness in shielding your properties.

Legal Factors To Consider When Developing an Offshore Count On

When you're establishing an offshore trust fund, recognizing the lawful landscape is vital. You'll require to thoroughly select the appropriate jurisdiction and assurance conformity with tax obligation regulations to safeguard your possessions properly. Ignoring these elements might cause pricey mistakes down the line.

Jurisdiction Choice Requirements

Selecting the best territory for your overseas count on is important, as it can considerably influence the efficiency of your possession protection technique. The ease of trust fund facility and continuous administration additionally matters; some territories provide streamlined procedures. Furthermore, assess any kind of personal privacy laws that safeguard your info, as discretion is usually a crucial incentive for choosing an offshore count on.

Conformity With Tax Rules

Recognizing compliance with tax obligation laws is vital for the success of your overseas trust fund. Stopping working to report your overseas trust fund can lead to severe fines, including significant fines and prospective criminal costs. Consulting a tax obligation professional who specializes in offshore counts on can assist you browse these intricacies.

Potential Tax Benefits of Offshore Depends On

While many individuals think about offshore trusts mainly for property defense, they can additionally offer considerable tax benefits. By putting your possessions in an offshore trust fund, you may benefit from a lot more favorable tax obligation therapy than you would certainly get in your find more info home nation. Numerous jurisdictions have reduced or zero tax obligation rates on revenue produced by assets kept in these counts on, which can lead to significant cost savings.

In addition, if you're a non-resident recipient, you may avoid certain neighborhood taxes totally. This can be especially useful for those seeking to preserve riches throughout generations. Furthermore, overseas counts on can offer flexibility in dispersing income, possibly allowing you to time circulations for tax effectiveness.

Nonetheless, it's vital to seek advice from a tax professional accustomed to both your home country's legislations and the offshore jurisdiction's regulations. you could try here Making use of these potential tax advantages calls for careful planning and conformity to ensure you remain within lawful borders.

Obstacles and Threats Related To Offshore Counts On

Although offshore counts on can use many advantages, they additionally feature a selection of obstacles and threats that you need to carefully consider. One significant challenge is the complexity of establishing and maintaining the trust. You'll require to browse numerous lawful and regulative demands, which can be lengthy and may require expert guidance.

Additionally, prices can escalate quickly, from legal costs to recurring management expenditures. It's likewise crucial to acknowledge that offshore counts on can attract scrutiny from tax authorities. If not structured correctly, you might encounter fines or raised tax obligation obligations.

In addition, the possibility for changes in legislations or political climates in the jurisdiction you've chosen can pose dangers. These modifications can impact your depend on's effectiveness and your accessibility to properties. Inevitably, while overseas depends on can be beneficial, comprehending these obstacles is vital for making notified decisions about your asset protection strategy.

Picking the Right Jurisdiction for Your Offshore Count On

How do you select the best territory for your offshore count on? Begin by taking into consideration the lawful structure and asset protection laws of prospective territories.

Next, consider tax ramifications. Some jurisdictions use tax advantages, while others could not be as favorable. Offshore Trusts. Ease of access is another element-- choose a location where you can quickly communicate with trustees and legal specialists

Ultimately, consider the political and economic stability of the territory. A secure environment guarantees your properties more info here are less most likely to be impacted by unanticipated modifications. By very carefully evaluating these aspects, you'll be much better outfitted to choose the ideal territory that straightens with your property security objectives.

Actions to Developing an Offshore Depend On Effectively

Establishing an offshore count on successfully needs cautious planning and a series of strategic actions. You require to pick the ideal territory based on your possession defense objectives and lawful requirements. Research study the tax obligation effects and privacy legislations in potential places.

Following, pick a trustworthy trustee who comprehends the nuances of offshore depends on. This individual or establishment will certainly handle the trust fund and assurance conformity with neighborhood regulations.

Once you've chosen a trustee, draft a complete count on deed describing your objectives and the recipients included. It's a good idea to seek advice from legal and financial experts throughout this procedure to confirm everything lines up with your goals.

After finalizing the documentation, fund the trust fund by transferring properties. Keep interaction open with your trustee and evaluate the trust occasionally to adjust to any modifications in your scenario or relevant legislations. Following these actions faithfully will assist you establish your overseas count on properly.

Regularly Asked Concerns

Just how much Does It Cost to Establish up an Offshore Trust?

Establishing up an offshore trust generally costs between $5,000 and $20,000. Factors like intricacy, jurisdiction, and professional costs impact the total price. You'll want to budget for recurring upkeep and lawful costs as well.

Can I Be Both the Trustee and Beneficiary?

Yes, you can be both the trustee and beneficiary of an overseas depend on, but it's important to recognize the legal ramifications. It may make complex asset security, so take into consideration speaking with an expert for advice.

Are Offshore Trusts Legal for US People?

Yes, overseas counts on are lawful for U.S. people. However, you should follow tax obligation coverage needs and guarantee the trust fund lines up with united state regulations. Consulting a legal professional is essential to navigate the complexities included.

What Occurs if My Offshore Count On Is Tested?

If your offshore depend on is challenged, a court might scrutinize its authenticity, potentially causing asset healing. You'll require to supply evidence supporting its credibility and function to prevent any type of claims effectively.

Just how Do I Pick a Trustee for My Offshore Count On?

Choosing a trustee for your overseas trust fund includes assessing their experience, credibility, and understanding of your objectives. Seek somebody trustworthy and experienced, and make sure they recognize with the regulations regulating overseas depends on.